Everybody wants to earn money nowadays. Investing a little and expecting maximized returns are very much the expectations of people nowadays. Fortunately, this is very much possible now. You can invest 300 per day and earn 1.31 crore. Yes, that’s right.

Table of Contents

Invest 300 per day and earn 1.31 cr

You can use several online Mutual Fund Systematic Investment Plan (SIP) calculators, which are provided free of charge by prominent companies such as SBI and HDFC Mutual Funds, to estimate roughly how much wealth you could gather over time by investing as little as Rs 100, Rs 200, or Rs 300 per day.

Today in this blog, we are going to talk about a scheme that is sure to boost your money game with a small amount of investment.

Within the complex world of personal finance, where several complex investment possibilities are scattered throughout, the Public Provident Fund (PPF) serves as a pillar of stability and security in terms of collecting assets. We are starting a journey today to understand the PPF plan, a government-backed savings program that has helped many people achieve long-term financial security.

WHAT IS THE PPF SCHEME?

LET’S TALK ABOUT PPF SCHEME:

The Indian government launched the Public Provident Fund (PPF), a savings and investing program, to promote modest savings and long-term wealth building for citizens. This well-liked financial tool is well-known for its minimal risk and tax advantages.

ADVANTAGES OF USING THE PPF SCHEME:

- LONG-TERM INVESTMENT: The PPF scheme is made for long-term investment over a period of 15 years. After these 15 years, the account can be extended in blocks of 5 years.

- INTEREST RATE: The government determines the interest rate on PPF, and it may change from time to time. Every year, the interest compounded. PPF interest rates have always been competitive when measured against those of other fixed-income securities.

- TAX BENEFITS: Under Section 80C of the Income Tax Act, contributions paid to a PPF account are deductible from taxes in India. The amount of the maturity and the interest collected are both tax-free.

- MINIMUM AND MAXIMUM CONTRIBUTION: People must contribute a certain amount each year and can start a PPF account with a minimal deposit. The government also sets a maximum contribution amount for every tax year.

- WITHDRAWAL AND LOAN FACILITY: Withdrawals in part are permitted starting in the seventh year. From the third to the sixth financial year, the account holder may also be eligible for a loan secured by the PPF balance.

- ACCOUNT EXTENSION: Withdrawals in part are permitted starting in the seventh year. From the third to the sixth financial year, the account holder may also be eligible for a loan secured by the PPF balance.

FORMULA USED FOR CALCULATING PPF:

F = P[({(1+i) ^n}-1)/i]

This formula represents the following variables:

- I: Rate of interest

- F: Maturity of PPF

- N: Total number of years

- P: Annual installments

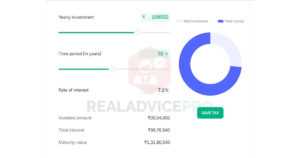

An example of how the PPF scheme works:

HOW CAN A PPF CALENDER HELP YOU?

One can get the answers to their questions about Public Provident Fund accounts by using this financial instrument. The maturity amount after a specified period of time must be calculated according to a set of rules. It monitors the expansion of your capital. Individuals who now own PPF savings accounts are aware that interest rates vary every month.

These days, monitoring shifting rates is simpler. But account holders now find it simpler to learn about interest rate adjustments on a regular basis thanks to the public provident fund calculator. Groww is a reliable alternative for selecting from the many user-friendly PPF calculators available on the market.

ADVANTAGES OF USING A PPF CALENDAR:

The advantages of using an online PPF calculator are listed below.

- With the use of a device, customers can clearly figure out how much interest can be made on an investment of a certain sum of money.

- This calculator might help you avoid having to pay a large amount of tax.

- The computer equipment must be supplied with the deposited amount and deposit type (variable or fixed) in order for the user to receive an accurate result.

- Additionally, it provides a prediction of the total expenditure for one financial year.

- We frequently struggle to choose the maturity time for our investments, but the PPF calculator makes this decision simple.

HOW TO USE A PPF CALENDAR:

You have to understand how this computer equipment functions if you want to get the most out of it. Its accurate and user-friendly information makes it a worthwhile investment. The user’s sole task is to enter data into designated columns, after which they are ready to proceed. Ownership, total amount invested, interest earned, and amount invested either monthly or annually are among the details that must be entered into this PPF amount calculator.

- The entire maturity amount will be displayed in a matter of seconds once the amounts have been entered in the required areas.

- When a single person deposits money on April 1st, interest is computed according to the year’s budget. This interest rate could be impacted by inflation.

HOW TO APPLY ON PPF?

Now, let’s talk about how you can apply for PPF both offline and online.

HOW TO APPLY FOR PPF OFFLINE?

The payment can be made with cash, a check, or a demand draft. To make a deposit, complete Form B, also known as a PPF deposit challan. There will be two counterfoils on the deposit slip: one for the agent and one that you should save as a receipt, in addition to the main portion. If you are investing directly, ignore the agent copy and complete the form and counterfoils. You will need to provide your name, address, PPF account number, the amount you want to contribute, and the specifics of your investment method (cash or check). After stamping the paperwork, the teller will give you your counterfoil.

Make sure your passbook is up-to-date if you have one. Your passbook won’t be updated if you’re depositing with a check until the check is released. In the event that you make a cash deposit, the bank will promptly update your passbook.

HOW TO APPLY FOR PPF ONLINE:

If your PPF account and savings are held by the same bank, you can make deposits online via a third-party transfer or a funds transfer (if the accounts are in separate banks).

You must first connect to your Net Banking account and add your PPF account as a beneficiary before you can make an online deposit. Once your PPF account has been nominated as a beneficiary, transferring money via net banking or mobile banking is simple.

You can give your bank standing orders to automate the process, in which case your PPF investments will be credited automatically.

BANKS WHERE YOU CAN APPLY FOR THE PPF SCHEME:

In India, post offices and approved banks provide the Public Provident Fund (PPF) program. The banks listed below are where you may apply for a PPF account, as per my most recent knowledge update from January 2022:

- STATE BANK OF INDIA (SBI)

- ICICI BANK

- HDFC BANK

- AXIS BANK

- PUNJAB NATIONAL BANK

- BANK OF BARODA

- CANARA BANK

- INDIAN OVERSEAS BANK

- CENTRAL BANK OF INDIA

Here, we showed you the basics of the PPF scheme before you started applying. But there are many ways to make money online instantly. There are many money making apps and money making websites available that will help you to make money passively. Click here to learn more about Realadvicepro.